all the news about mobility

Investors are moderately optimistic about prices, which have risen slightly. Uber Technologies did not make a profit in the fourth quarter, but saw revenue increase due to growth in taxi services and food delivery. This made the company, which calls itself an IT Software & IT services provider, less loss-making than a year earlier when the fourth quarter showed a loss of $ 817 million in the books.

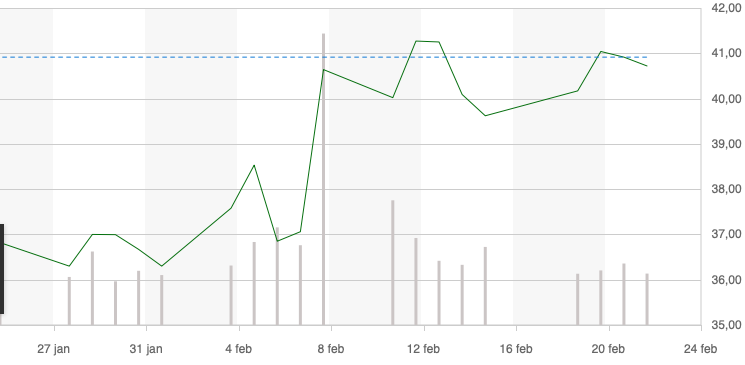

There is a positive trend in the short term. Above USD 37,6, an initial price cap may be set at USD 41,27. Only the breach of rates above USD 32,62 would confirm a trend reversal in the medium term.

venture capital accounts for billions of losses

The net loss rose to $ 1,1 billion. Over the year, Uber posted a net loss of $ 8,5 billion. Sales rose 37 percent to $ 4,1 billion. This was due to the rapid growth of new activities. A smaller part of the turnover was also spent on marketing and discounts than a year earlier.

Uber has discontinued meal delivery in South Korea and sold its Indian meal delivery branch last month. These two steps contributed significantly to the negative adjusted EBITDA result of Uber Eats in 2019 and should improve the outlook for the division in 2020. The stock has continued to rise on the stock markets in recent weeks.

Also read: Taxi drivers Uber are driving badly but are not getting around